Some of the Tools

Dubai International Financial Centre (DIFC) Prescribed Companies (“PresCo”) are flexible, Common law-denominated, private companies limited by shares.

Introduced by the DIFC to replace the previous Intermediate Special Purpose Vehicles (ISPVs) and Special Purpose Companies (SPCs) regimes, they are designed to meet the particular needs of funds, private equity firms, family offices and other investment-related entities (Holding and Investment Companies), particularly with respect to domestic and regional assets.

As is the case for ADGM SPVs – see our fact sheet here

- PresCos are so-called “exempt” structures: they do not fall under the direct supervision of the DFSA, the financial services regulatory authority

- PresCos are compatible with sophisticated ownership structures – e.g. trusts/foundations.

Prescribed Companies in practice

|

Prescribed Companies in practice

|

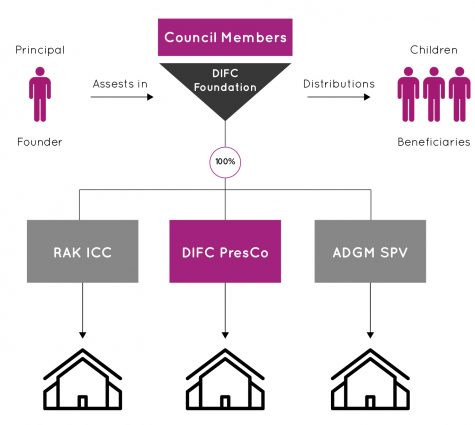

Case Study: Use of PresCos in conjunction with foundation as holding vertical for real estate assets

A prominent member of a UAE family (the “Principal”) holds a large portfolio of real estate assets across the UAE in his personal name.

He wishes to ensure that his assets are consolidated and passed on to his sons and daughters without dilution, with each child an equal beneficiary.

In compliance with regulations/practices of each relevant Land Department, he sets up one holding structures per specific Emirate; a DIFC PresCo is constituted fir Dubai assets.

A DIFC foundation is then registered and shares of all holdings settled onto it, with children as beneficiaries in equal parts. the real estate portfolio is consolidated under the structure [applicable transfer fee of 0.125% (as opposed to 4%) of the value of the real estate assets].

What improves?

- Distribution of proceeds as per Principal’s wishes

- Access to DIFC’s Common law regulatory framework

- Protection against potential (creditors’) attacks

- Privacy

- Cost-Effective tools