Some of the Tools

There are two investment locations in the UAE:

- Mainland UAE, where three main types of entities are available (i.e. limited liability companies (“LLCs”), branches and civil companies/sole establishments) where 100% ownership is permitted, but in certain circumstances only; and

- Free zones, which allow 100% foreign ownership for all activities but subject licensed companies to restrictions in terms of geographic scope of their operations.

To access the UAE market and cater to locally-based customers or governmental bodies, the establishment of a mainland entity is the only viable option.

Effective 1 June 2021, the historic requirement for a UAE national to hold 51% of the share capital of LLCs was removed.

Complete foreign ownership of LLCs is now permitted for companies carrying on an activity permitted by the department of economic development in each Emirate to be undertaken by a 100% foreign owned company (“Permitted 100% List”) and provided that the activity is not deemed by a federal committee to have a “strategic impact”, in which case some degree of Emirati ownership requirements will remain.

UAE mainland establishments eligible for 100% foreign ownership

For existing LLCs eligible to transition to 100% foreign ownership, the pathway to achieve 100% foreign ownership requires:

- the execution of a share transfer agreement before the notary public to transfer the shares from the UAE national shareholder to the foreign shareholder (who may or may not be an existing shareholder); and

- amendment to the trade license of the LLC with the department of economic development in the relevant licensing emirate.

For first time market-entering businesses eligible for 100% foreign ownership, the cost and process of establishment of an LLC has been significantly streamlined. There is no longer the need to identify and contract with a UAE national for a fee or fixed percentage of the LLC’s profit as a condition to establishing and operating an LLC. The immediate benefit is to reduce operating costs and it is expected to accelerate the establishment process.

In both cases, incorporating simple structural enhancements e.g. combining a DIFC prescribed company, ADGM SPV and/or foundation with an operational LLC – can provide businesses with immediate value by reducing shareholder risk, increasing attractiveness for private investment and ensuring business continuity.

UAE mainland establishments eligible for 100% foreign ownership – in practice

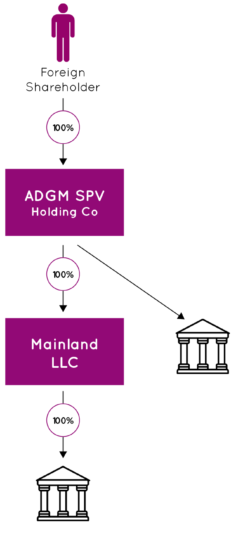

Case study

- Leading American petrochemical trader wants to set up a petrochemicals trading business in the UAE

- Sets-up an SPV in the ADGM to act as a holding company of the shares in the mainland LLC

- Sets-up a mainland LLC with the activity of “petrochemicals trading” contained in the 100% Permitted List published by the Dubai Economy

What is achieved?

- Ability to undertake trading activities in the mainland UAE and access the local market

- Split between operational vehicle and holding structure to provide asset protection and facilitate the ease of investment and divestment without causing business disruption

- Lift ownership of LLC from UAE mainland to ADGM (i.e. from civil law to common law framework):

- access to a sophisticated regulatory regime and corporate tools (i.e. possibility to introduce classes of shares, pledge of shares)

- Less red tape: local notary public are not involved for transfer of shares (occurring at ADGM SPV level)

- important savings (no legalization/super-legalization of documents unlike where a foreign holding co is used)

UAE mainland establishments not eligible for 100% foreign ownership

For existing LLCs or market-entering businesses undertaking or seeking to undertake an activity which is:

- not contained in a Permitted 100% List;

- deemed to be an activity with “strategic impact” and therefore not eligible for 100% foreign ownership; or

- operationally and strategically beneficial to be undertaken by an LLC with UAE national shareholder,

then with the appropriate risk mitigation documentation in place, entrusting 51% or less of the shares to a UAE national should not be seen as a drawback. Compliant tailor-made mechanisms can mitigate – to the point of elimination – risks associated with having a local partner and ensure that the foreign investor retains full control over management and profits.

As best practice, stakes in UAE mainland entities may be held through domestic Special Purpose Vehicles (SPVs).

While traditional offshore centers like the BVI, Cayman Islands or Channel Islands have advantages – e.g. robust common law framework, substantial track record – they are not without downsides: e.g. delay in implementation of decisions (even if the SPV is effectively managed in the UAE), important costs related to legalization/super-legalization of documents. Investors may now use SPVs available in the local highly credible, versatile common-law denominated jurisdictions (ADGM and DIFC) to add value to their business.

UAE mainland establishments not eligible for 100% foreign ownership – in practice

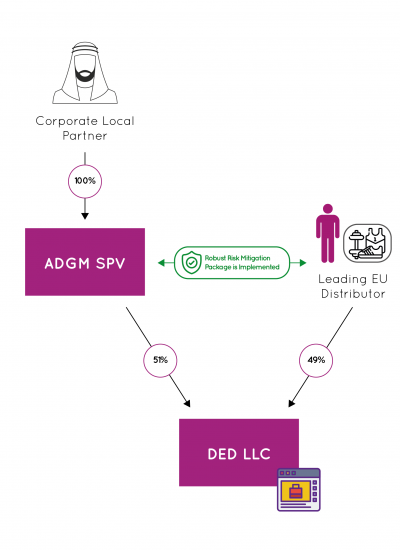

Case study

- Leading European distributor of sport clothes

- Aims at distributing products via an e-commerce platform in the UAE

- Sets-up a DED LLC with a specific distribution activity not eligible for 100% foreign ownership

- 49% of the capital is owned by an ADGM SPV and 51% by a corporate local partner also structured via a SPV

- A robust risk mitigation package is implemented

What is achieved?

- Ability to import products into the UAE and access to local market

- Increased investor protection and full control over management and profits of the E-commerce Co

- Split between operational vehicle and holding structure

- Lift from UAE mainland to ADGM (i.e. from civil law to common law framework):

- shareholders’ relationship fenced within a common law framework

- access to a sophisticated regulatory regime and corporate tools (i.e. possibility to introduce classes of shares, pledge of shares)

- Less red tape: local notary public are not involved for transfer of shares (occurring at ADGM SPV level)

- important savings (no legalization/super-legalization of documents unlike where a foreign holding co is used)

The roll out of the 100% foreign ownership rules is still in its early stages. Guidance is regularly issued by departments of economic development in each Emirate, with more to come. The impact of the foreign ownership rules on your business or planned business in the UAE will depend on your activities or planned activities and operational requirements.