Available in the two UAE’s financial free zones, funds and foundations both enable the acquisition and ownership of assets through a vehicle independent from the investors/founder. They are usually used in different scenarios, to achieve different objectives.

Whilst Funds are typically structured for investment ventures, involving third party investors who participate in the profits generated by the fund, they fail to address key concerns when it comes to legacy planning and asset protection. The individual investor/s is/are still exposed to 3rd parties’ attacks and units held in an individual capacity remain subject to probate procedure in case of demise. This is where a Foundation adds value to a fund structure.

Compatible with all UAE and most international asset classes (real estate, shares, portfolios), Foundations enable entrepreneurs and their families to consolidate and keep control over income-generating assets and investments, while protecting them from potential threats. They are equally effective for Muslims and non-Muslims.

Foundations can be used in combination with funds, e.g. structuring co-investments, club deals, evergreen investment vehicles and smaller bespoke arrangements, thereby guaranteeing business continuity and smooth intergenerational planning.

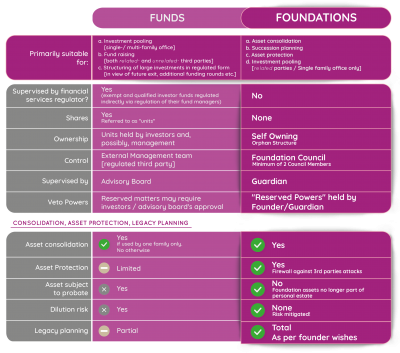

The below chart highlights the key features and advantages of the foundation and fund tools.

To find out more, read our article penned in collaboration with Morgan Lewis

See our Mail Alert Get in touch – To get the latest Mail Alerts

For more information on this topic, please see our publications:

The Match: Will vs Foundation

The Match: Companies vs Foundation

UAE Foundations: The Gateway to Middle East assets for Foreign Fiduciaries

UAE Private Wealth Series (III) – Legacy Planning

M/HQ’s SME Clinic – Video Series:

M/HQ’s SME Clinic – video series: UAE Foundations for Muslims

M/HQ’s SME Clinic – video series: UAE Real Estate Structuring