Some of the Tools

Yann Mrazek addressed the practical aspects of UAE Foundations, notably touching on the

Available domestically since 2017, Foundations have rapidly become the go-to option for regional wealth structuring and inter-generational legacy planning.

The Foundation shares similarities of functions and mechanisms with both a company and a trust, while not strictly a hybrid of the two. It is similar to a company in that it is an independent legal entity with a distinct personality, separate from the founder. However, it has no shareholders or members and does not issue shares or other legal titles of ownership. It is a so-called ‘orphan’ structure.

A foundation is governed by its Charter and By-laws. The Charter is publicly available; the By-laws are strictly private. Foundations are managed by a foundation Council and may be supervised by a guardian.

A foundation must be registered with the relevant registrar, and its place of registration be located within the respective jurisdiction. In most cases, a registered agent – a “qualified person” licensed by ADGM/DIFC to carry out such activity – will have to be appointed.

The scope of permitted objects is broad. It may be philanthropic but not commercial. The foundation may enter into contracts or hold assets in its own name. Both ADGM and DIFC foundations are allowed to own real estate plots, lands or properties within the Emirate of Dubai.

Following the creation of a foundation, the founder may opt to retain significant control powers via the By-laws, a great advantage compared to a standard trust. He can be one of the council members and/or one of the beneficiaries.

Foundations have been introduced domestically with Muslim successions in mind. Within designated parameters, foundations can be considered by Muslim families who wish to respect Islamic law principles on inheritance.

Used adequately, foundations provide robust asset protection, safeguarding the foundation’s assets from forced heirship or creditor claims.

A foreign foundation can migrate from abroad into ADGM/DIFC.

Foundations in practice

Primarily used for:

- Wealth structuring, inter-generational legacy planning

- Asset protection (forced heirship rules, creditors, hostile takeovers)

- Long term holding structure of income generating assets (businesses, real estate portfolios)

- Philanthropic purposes

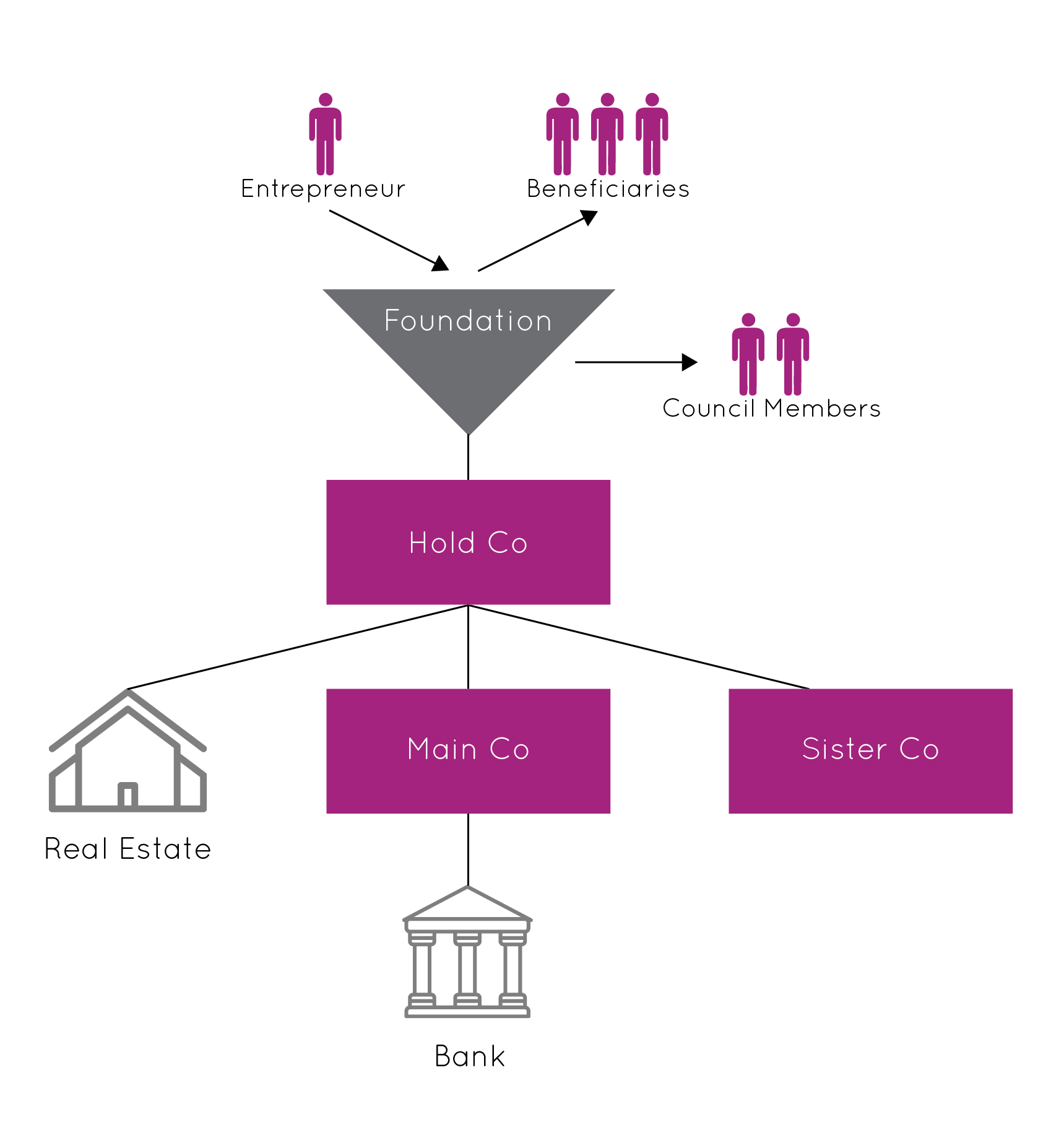

Case study

- Leading UAE distribution and retail group, family-owned and operated

- Group counts numerous operational entities, each directly owned by Patriarch

- Client aims to consolidate his UAE businesses under a holding structure to ensure:

- Asset protection and preservation (against creditors’ attacks)

- Shariah-compliant Legacy planning strategy

- Control during lifetime

What improves?

- Consolidation of all operational entities under single HoldCo structure – ADGM SPV, held by ADGM Foundation

- Group assets segregated from Family’s direct ownership: no longer subject to probate or creditors’ attacks

- Family (and Patriarch) maintains operational control

- Distribution of proceeds in accordance with Sharia principles

- fast implementation of decisions (single jurisdiction)

- important savings (no legalization/super-legalisation of documents unlike where a foreign holding co is used)

Recent Work

- Advised numerous UAE based entrepreneurial families on the restructuring and consolidation of their regional operational entities, taking legacy planning, asset protection, ownership restriction (UAE mainland) and tax (VAT) into consideration

- Advised numerous successful individuals on the restructuring of Dubai and Abu Dhabi real estate units previously held in name or through non-optimal corporate structures, using ADGM/DIFC Foundations

- Advised several high profile international families on the use of the UAE for asset consolidation and legacy planning, through a combination of tools (HoldCo, corporate migration, foundation, PTC)

- Advised several art collectors and art dealers on asset protection and legacy planning strategies in relation to their private art collection (use of ADGM foundation in combination with ADGM SPV)

Related publications

OPED – Foundations: Who is using them? – 30.05.21

UAE Private Wealth Series I: Foundation Comparison Sheet

UAE Private Wealth Series III: Legacy Planning

UAE Private Wealth Series IV: Structuring Dubai Real Estate

UAE Foundations: The Gateway to Middle East assets for Foreign Fiduciaries