Single Family Office (“SFO”) structures are increasingly gaining in popularity among family businesses in the Gulf Cooperation Council (the “GCC”).

In our twelfth episode, Célia Titouni, Senior Associate at M/HQ joins Yann Mrazek, Managing Partner at M/HQ, to compare the available SFO regimes locally, as well as their use in practice.

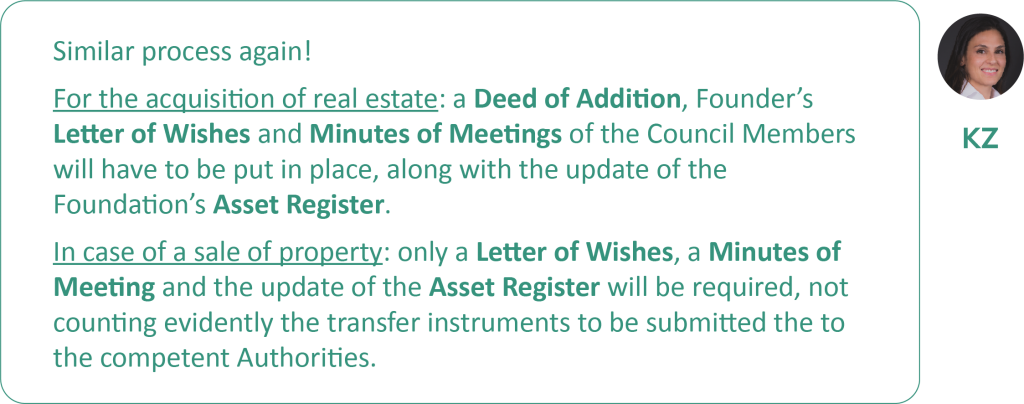

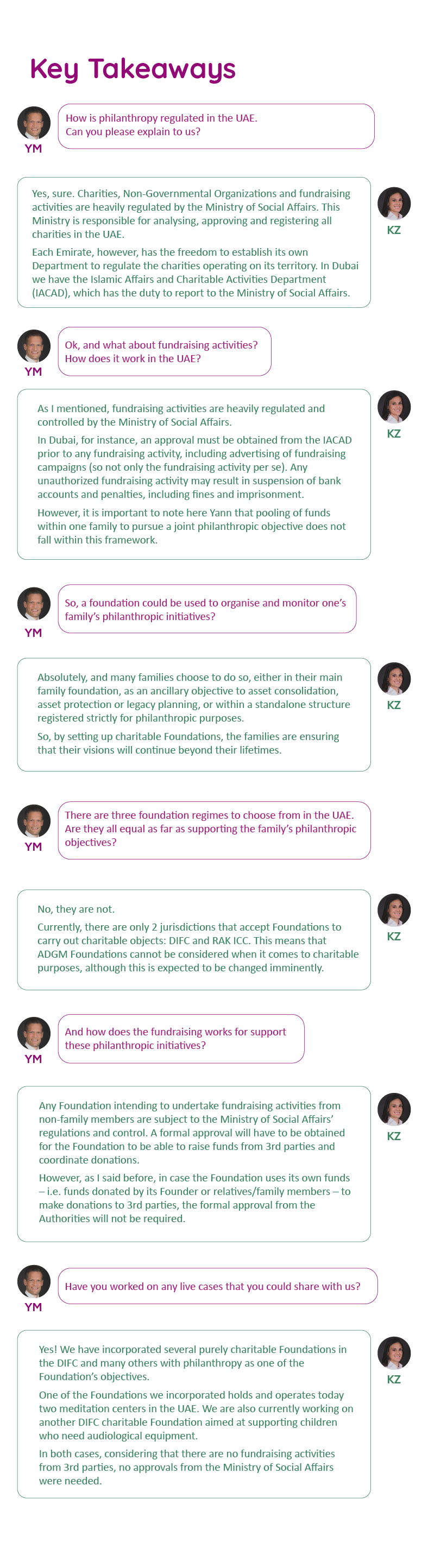

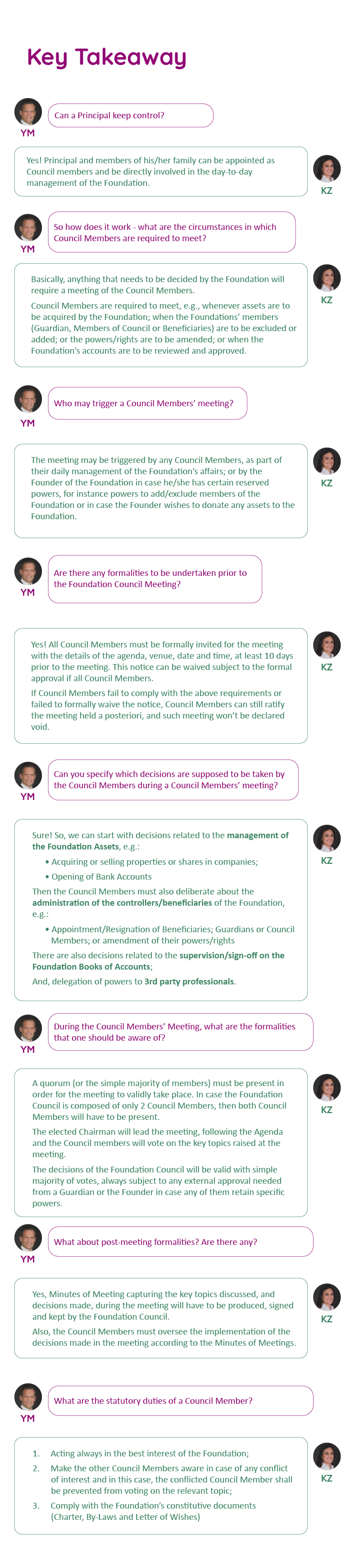

Key Takeaways

What is a SFO?

A SFO is a private entity aimed as managing the investments and affairs of one single family. The assets under management are the family’s own wealth, often accumulated over several generations. A SFO is restricted to provide services to members of one single family.

In addition to investment management, these entities typically also provide the following services:

- Succession planning

- Estate planning

- Tax planning

- Accounting and payroll activities

- Legal affairs management

Consolidating under one Family Holding – what advantages?

Consolidating high-value assets under one (or several) company/ies has a lot of advantages – e.g. asset/asset classes segregation, limited liability with respect to those assets, ease of (re)financing, facilitated transfer of ownership interests.

How is the current offering in the UAE?

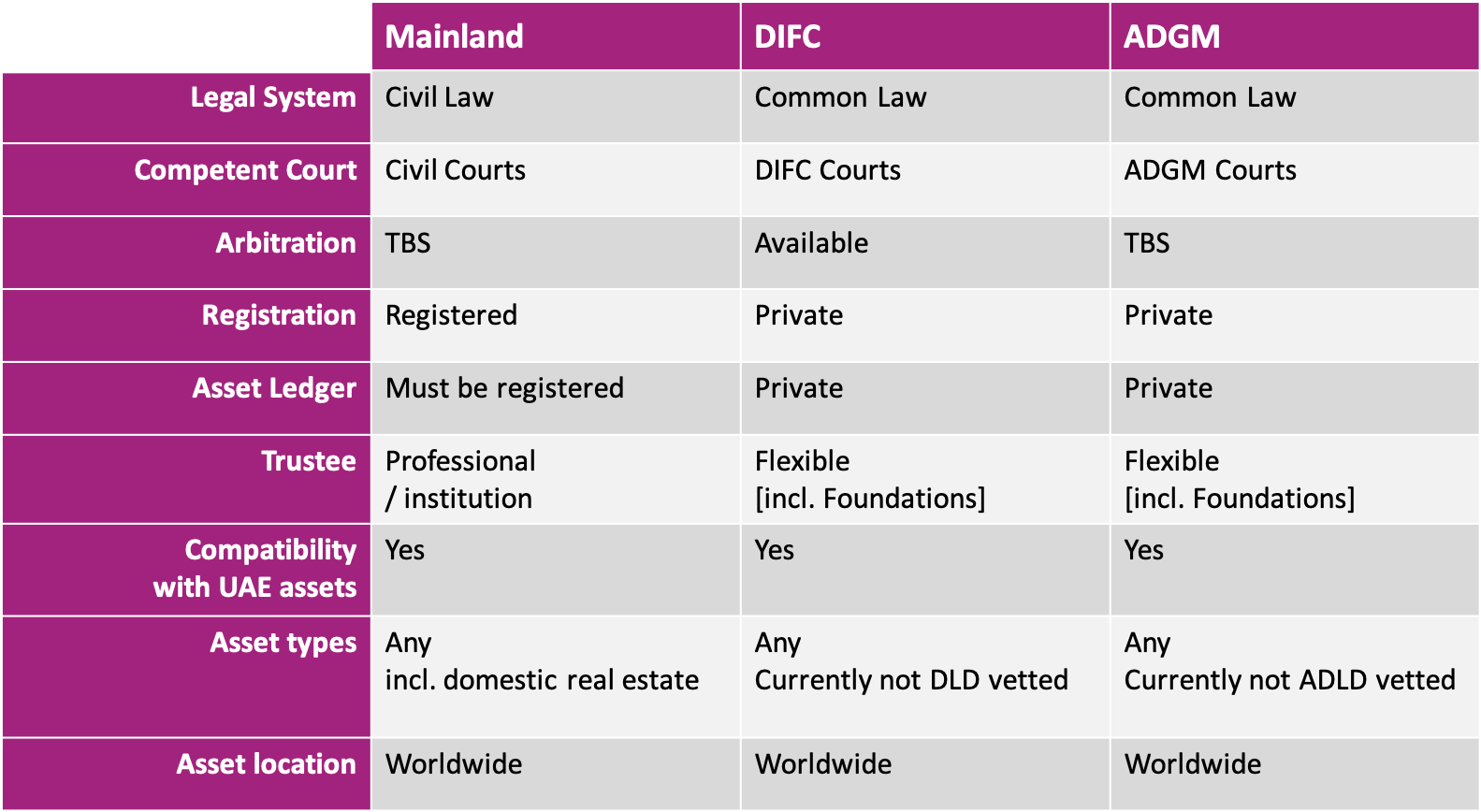

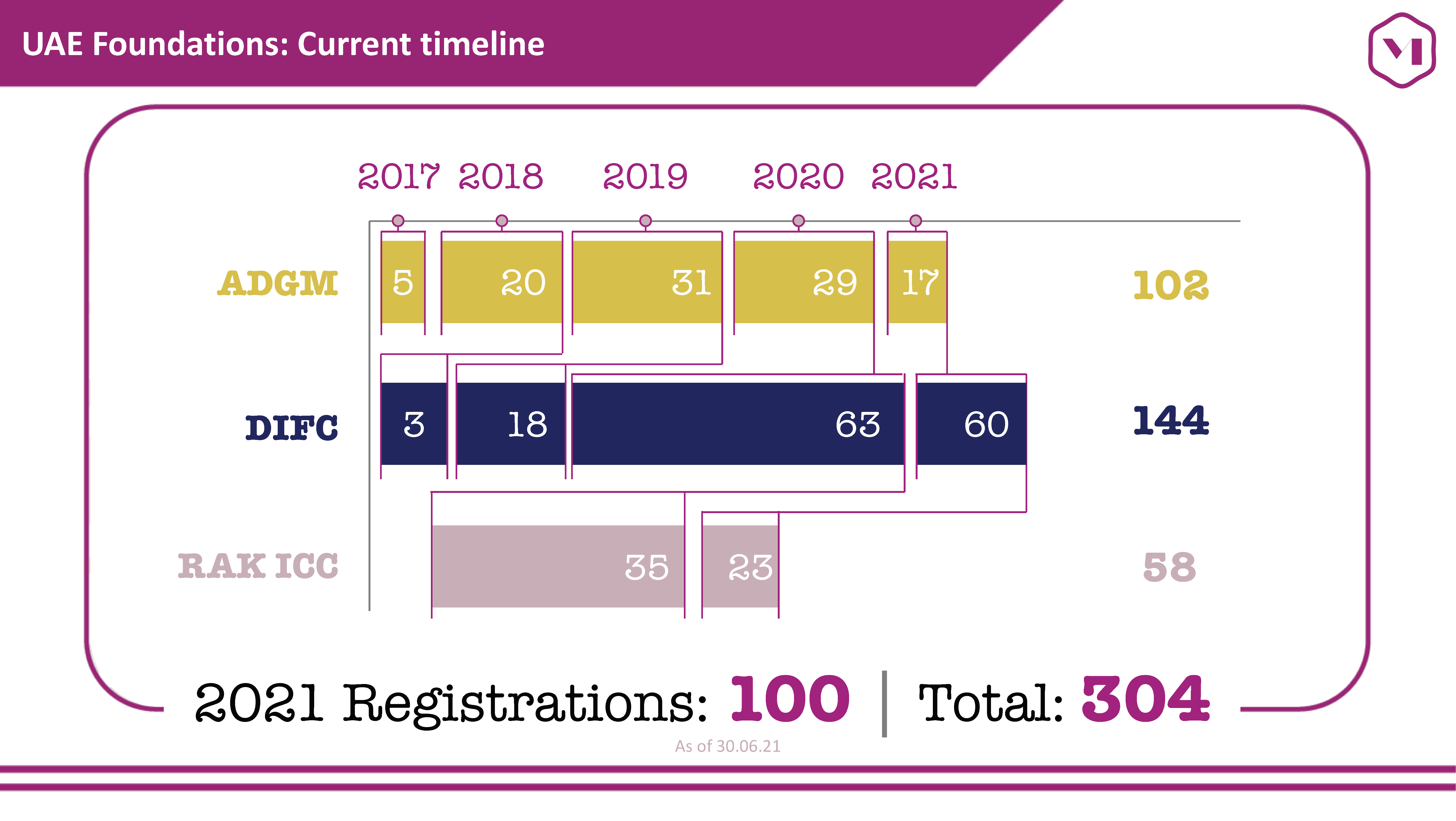

Regionally, three jurisdictions have created designated tools, namely: the Dubai International Financial Centre (the “DIFC”), the Abu Dhabi Global Market (the “ADGM”), and the Dubai Multi Commodities Centre (the “DMCC”).

How can one choose a regime?

All three are sophisticated options but ADGM and DIFC are in a class of their own in terms of sophistication and credibility.

ADGM has historically had the most flexible regime, with no minimal share capital nor investible funds and no requirement for a physical office. It also has no publicly available information. You can set-up a SFO in as short as a week.

In contrast, if one wishes to seek a DIFC SFO license, the centre imposes a minimum capital of USD 50,000, minimum liquid assets of USD 10 million and a physical office – save for exemptions where pre-existing substantial local presence can be demonstrated. It has slightly higher compliance and reporting requirements than its peer and a number of data, including the name of the current and former shareholders, will be available publicly. The set-up timeframe stretches to 1-2 months.

Both allow for the options to evolve within a regulated or supervised regime. They are also both common law centers with independent courts.

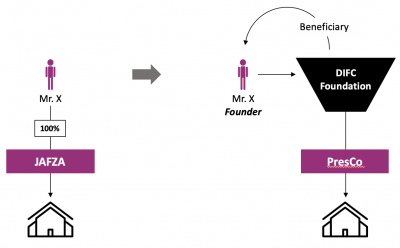

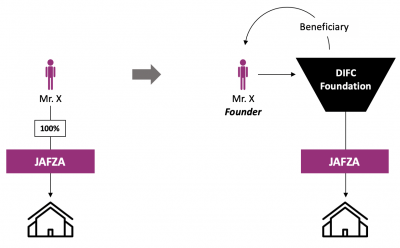

Of late, more flexibility has been introduced in the DIFC with the launch of Prescribed Scope Companies, and their subsequent reform, which can be used the same way.

A DIFC Presco is a light requirement / low costs structure designed for the conduct of passive activities, e.g. such as Holding Company, Proprietary Investment or Managing Office. It can be established by a Qualifying Applicant or for a Qualifying Purpose, as defined in the relevant regulations. DIFC Prescos are exempted from being physically present in the DIFC.

With the definition of “Qualifying Purpose” enlarged and of “Qualifying Applicant” expanded, large entrepreneurial families with operations and investments in the Gulf can easily avail access to the sophisticated DIFC regulatory environment.

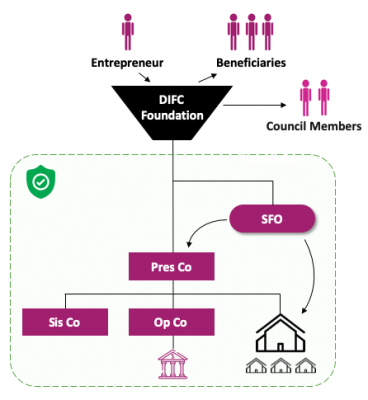

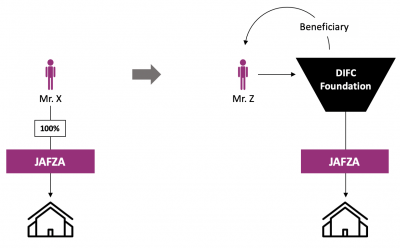

One of the main USPs is that they are compatible with foundations. They can indeed be used in conjunction with foundations to notably re-structure local conglomerate with large UAE presence.

How about DMCC?

If one wants an office, DMCC has the advantage of having a lot of options at all prices. But DMCC’s offering is less flexible, and arguably less credible. A “supervised” SFO can be established with a lower capital requirement (AED 50,000) and a minimum of USD 1 million of liquid assets which must show on the account within a year after set-up.

This option also imposes higher compliance and reporting requirements. In terms of privacy, it has the same amount of publicly available information as DIFC. The set-up timeframe is 2 months.

DMCC is the only option outside a common law center and, more importantly, where local courts will be competent.

Where do all three regimes fall short?

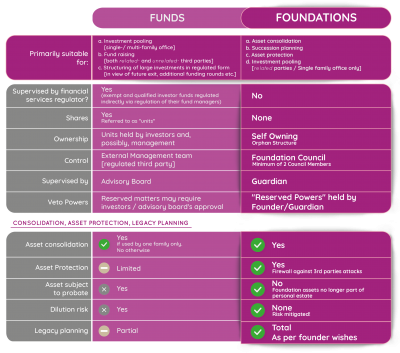

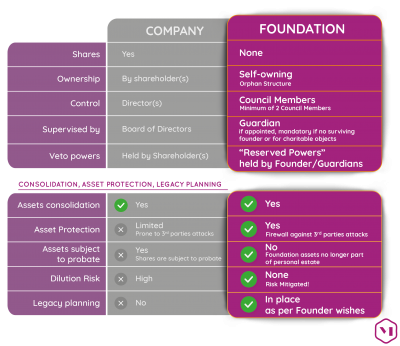

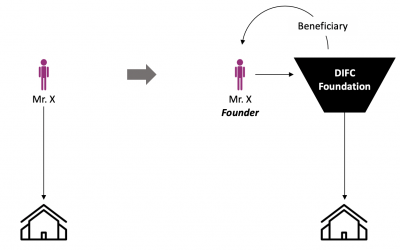

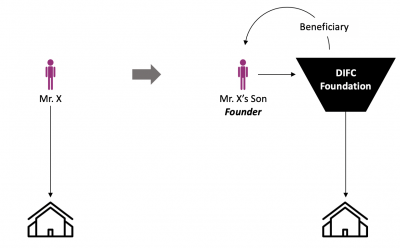

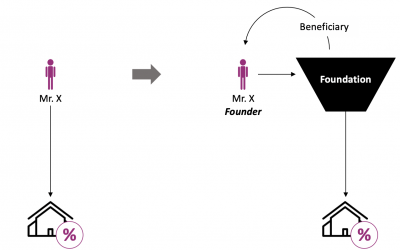

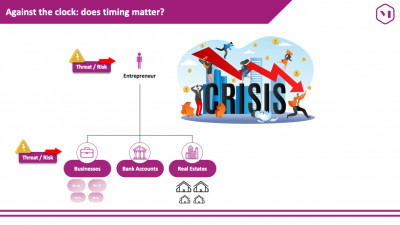

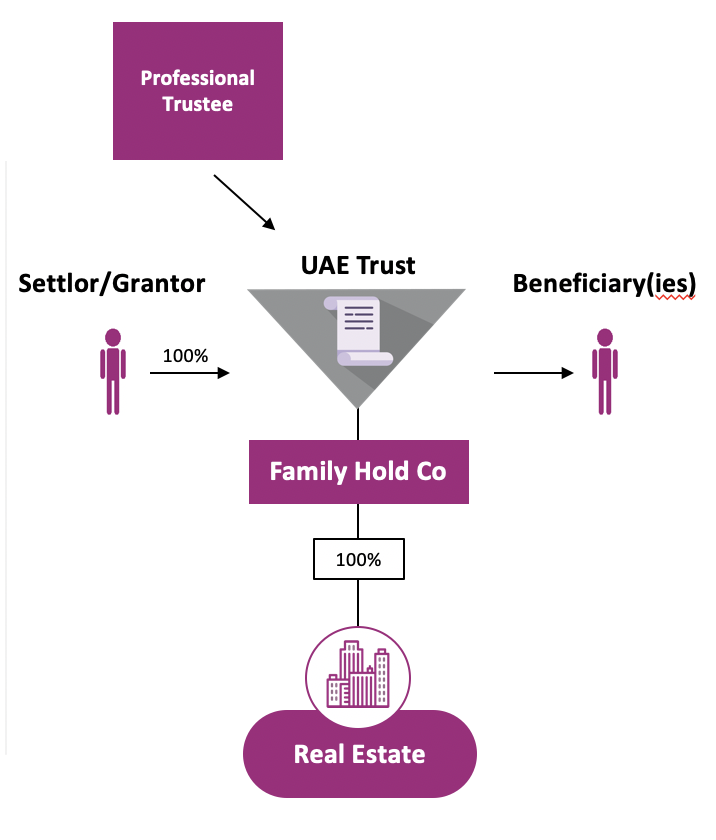

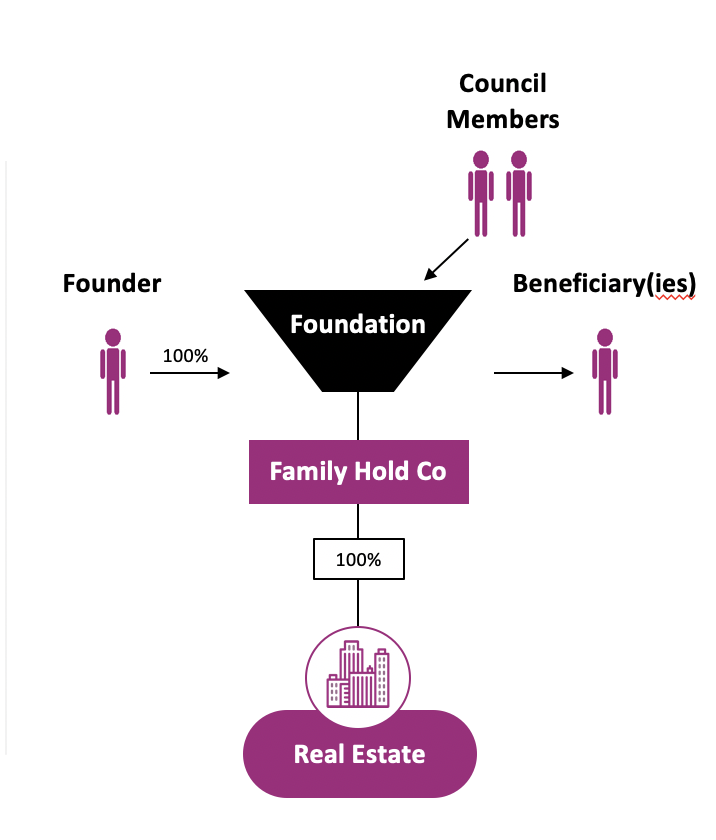

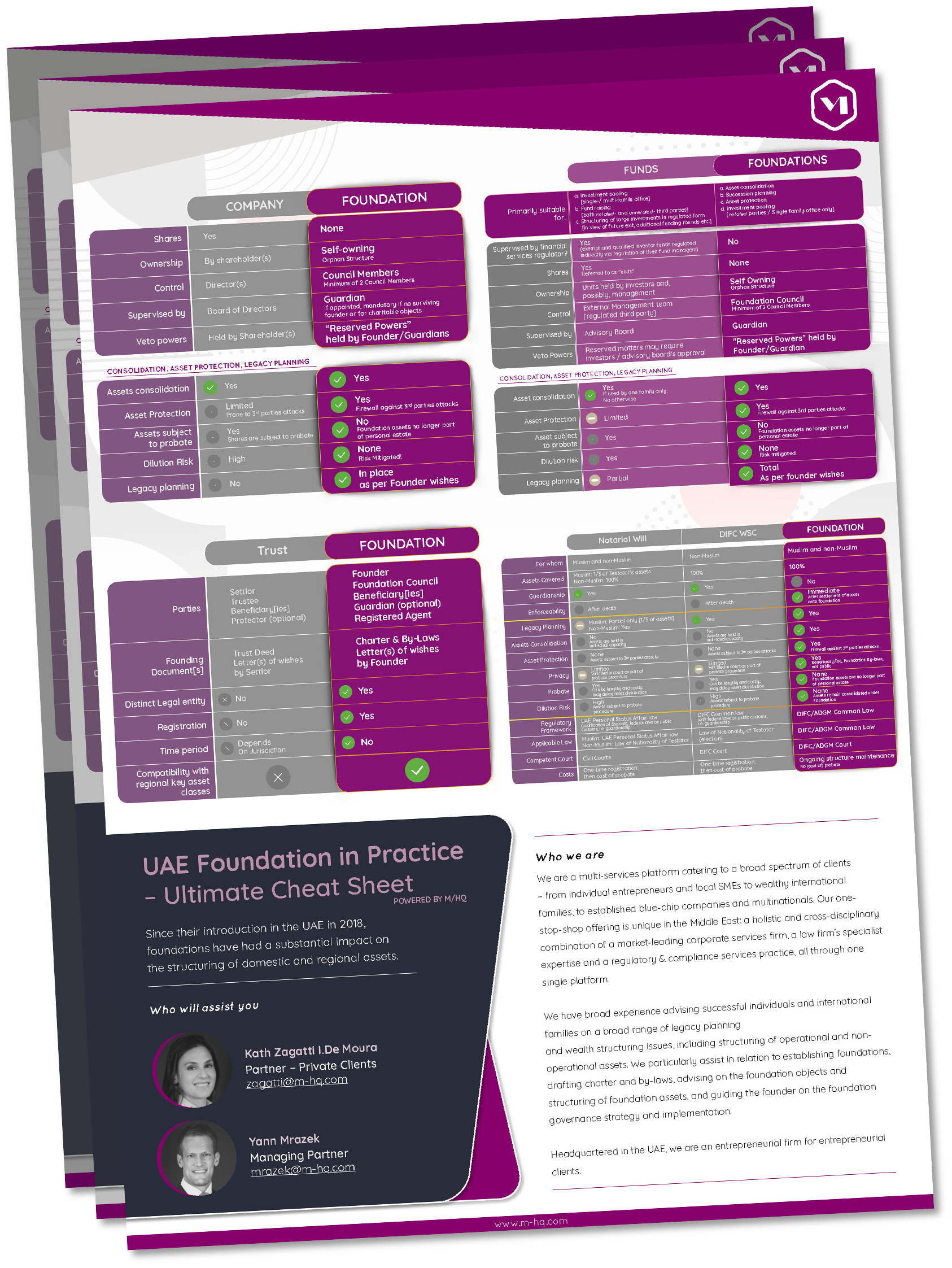

Traditional SFO / Family Holding consolidation structures often fail to address key concerns when it comes to legacy planning and asset protection.The individual shareholder/s is / are still exposed to 3rd parties’ attacks and shares held in an individual capacity remain subject to probate procedure in case of demise.This is where a Foundation adds value to a corporate structure!

How to mitigate the risks and how does a Foundation add value?

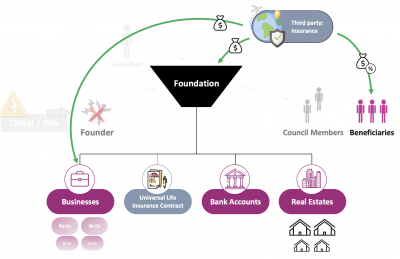

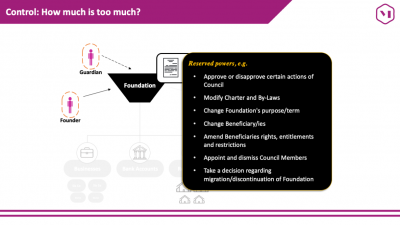

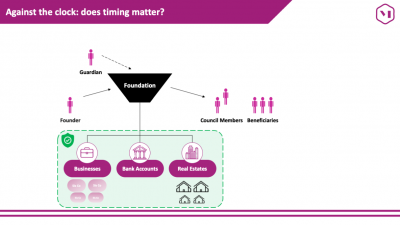

A Foundation is an independent legal entity with a distinct personality, separate from its founder. Compatible with all UAE asset classes (real estate, shares, portfolios), Foundations enable the entrepreneur and his family to consolidate and keep control over income-generating assets and investments, while protecting them from potential threats. They are equally effective for Muslims and non-Muslims.Foundations can be used in combination with corporate structures, e.g. holding shares of holding or operational companies, thereby guaranteeing business continuity and smooth intergenerational planning.

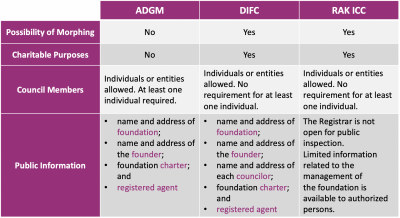

Key Differences:

Key Differences: